A personal loan is when you borrow money from a bank or credit union for a car, boat, student fees, debt consolidation, renovations, holidays, weddings and more.

Personal loans work by paying back the principal (amount that was borrowed) plus interest and any fees for the life of the loan which is usually 1-5 years and up to 7 years for some personal loans.

How does a personal loan work?

It is best to get pre-approval with any loan so you know how much you can borrow based on your income, expenses and credit rating. Assuming you are approved for a personal loan, this is how it works:

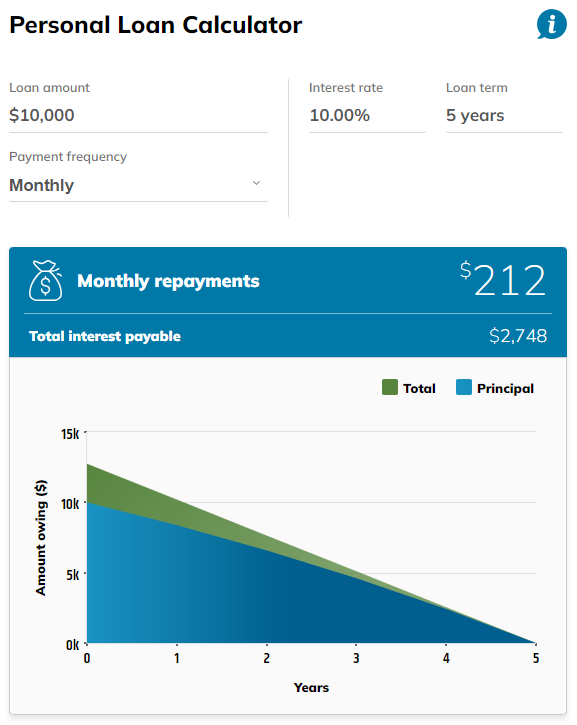

If you want to buy a car that costs $10,000 and you get a fixed rate loan for 5 years at 10% interest your monthly repayments will be $212 per month for 60 months (5 years).

Many personal loans also have fees, let's assume that in this example there is a $100 establishment fee which is payable at the start of the loan and a $100 annual administration fee.

This will bring the total cost of the loan to:

- $10,000 principal repayments

- $2,748 interest repayments

- $600 fees ($100 establishment fee plus x5 $100 annual fees)

Total cost of the loan over 5 years = $13,348

Unsecured vs secured loans

When getting a personal loan it is important to know the differences between an unsecured personal loan and secured personal loan.

Unsecured personal loans

An unsecured loan means that there is no 'security' for the bank or credit union to take back or sell if the borrower defaults on their loan repayments. Unsecured personal loans include debt consolidation loans, holiday loans and student loans.

Because there is no security, unsecured loans are a bigger risk and lenders charge a higher interest rate to cover the additional risk. Unsecured loans usually have a shorter loan term (maximum of 5 years instead of 7 for example) and a lower maximum loan amount compared to a secured loan.

Secured personal loans

A secured personal loan is 'secured' by an asset such as a car, motorbike or boat. In the case of the borrower defaulting on their repayments the bank or credit union can sell the security to recover the funds. Personal loan interest rates vary depending on whether a personal loan is unsecured or secured. A secured personal loan will have a lower interest rate, a higher maximum borrowing limit and you could possibly get a longer loan term compared to an unsecured loan.

Fixed or variable interest rates

Another major difference between personal loans is the interest rate, personal loans are either fixed or variable rate loans. Each type of loan has its own features and benefits.

Fixed interest rate

A fixed interest rate means that it is fixed for the fixed term which is usually the full 5 or 7 year term of the loan with a personal loan. The main benefit of a fixed rate loan is that you know exactly what the monthly repayments will be for the duration of the loan.

Fixed interest rate

loans tend to have more restrictions when it comes to making extra repayments and paying off your loan faster. Check the personal loan rules around extra

repayments, redraw and paying off your loan early before making a decision on a personal loan.

Variable rate loans

When you compare personal loan rates you must remember that variable interest rate loans can either increase or decrease over time which directly affects your monthly payment. Interest rates effect the interest repayments on your loan, to check how interest rates can affect your monthly payments use our helpful personal loan calculator.

Variable rate loans generally offer more flexible features when it comes to extra repayments, redraw facilities and paying out the loan faster. The main drawback with a variable interest rate, is that it offers less certainty than a fixed interest rate personal loan.

When to use a personal loan

Personal loans can be very useful for a number of people and reasons when you need to borrow money. When you consider a personal loan it is important to assess your ability to make repayments over the full term of the loan, considering potential changes to your personal circumstances, loan fees and interest rate changes (if you choose a variable rate loan).

Determining the best personal loan for you depends on your needs and financial goals.

This article is general in nature and does not constitute personal advice. Consider your circumstances and read terms and conditions before making a decision on whether a product suits your needs.