An offset account is an everyday bank account that is linked to your mortgage, and is sometimes referred to as a mortgage offset account. Offset accounts work by 'offsetting' your savings balance against your loan balance. Your loan interest is calculated on the remaining outstanding balance of your loan account.

How does an offset account work?

Offset accounts bring down the interest payments by reducing your home loan balance with the money in your offset accounts. Offset accounts are usually only available with eligible variable rate home loans.

Your home loan repayments are made up of two components:

-

Principal - this is the amount you borrowed.

-

Interest - this is the amount calculated based on the balance of the principle still owing.

The interest component is the only part of the repayments affected by an offset account.

In addition to these two components, you may have account keeping fees or ongoing home loan associated fees.

You need to check the terms and conditions of an offset account, as to when the institution calculates the interest on your loan, and applies the offset benefit. At Northern Inland, your offset account balance as at the close of business every day, is used to calculate your offset benefit, and accordingly, the interest that will be charged to your loan account at the end of the month.

Potential interest savings using an offset account

If you borrow $150,000 and maintain a balance of $10,000 in your linked mortgage offset account you will only pay interest on the $140,000 balance for that day. Note: interest on your loan is calculated daily.

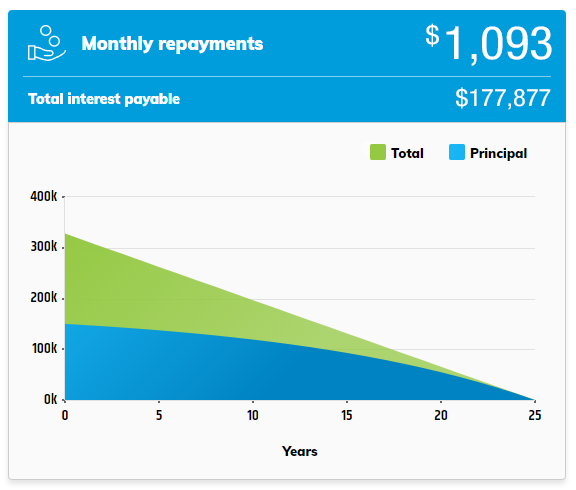

Without an offset account

The following examples are for illustrative purposes only: it is quite unlikely that a variable interest rate would remain the same for the entire term of a loan. Other costs, such as account keeping fees, have been excluded for the purpose of the examples.

Assuming an interest rate of 7.34% that does not change for the entire term of your loan, your regular monthly repayments would be $1,092.92 which is approximately $177,877 in interest to be paid over the 25 year loan term.

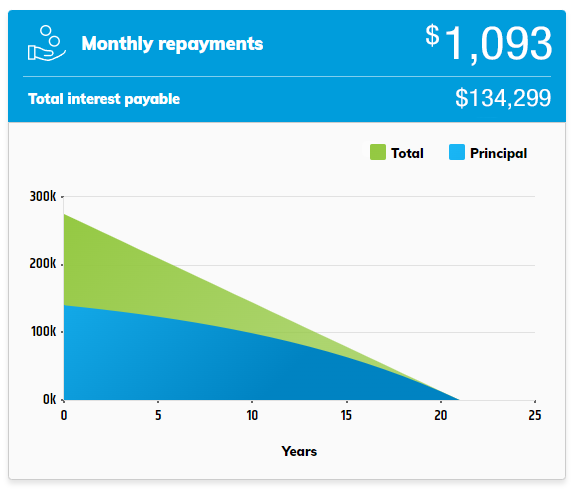

With an offset account

Assuming that the home loan interest rate with a linked offset account is also 7.34% for the entire term of your loan, and you maintained a constant $10,000 balance in your linked offset account you would pay off the loan in 21 years and pay approximately $134,299 in interest payments.

This represents a saving of 4 years and loan interest saving of approximately $43,577!

This scenario assumes that the variable interest rate and account balance remain the same over the life of the loan. It also doesn't take into account any fees associated with the loan.

Key benefits of an offset account

Reduce the amount of interest that is calculated as payable on your loan account by maintaining your savings in an offset account. Your money is at call, with a full range of access methods. Whilst your offset account is a non interest bearing account (that is, it doesn’t earn interest), it operates to help you save on the interest you would otherwise pay on your loan account.

To maximise the benefit of your offset account, you should aim to keep all your savings in an offset account.

At Northern Inland, you can have up to 6 offset accounts linked to your loan account, to assist you with budgeting and other household bill payments.

Consider the Target Market Determination, and Product Fact Sheet, to see if an offset account suits your needs. Speak to your accountant or financial planner for personal advice.

What are the disadvantages of an offset account?

Often, offset accounts are usually only available with variable rate home loans, most lenders do not offer offset accounts on fixed rate home loans. For a full comparison of home loan types see our fixed vs variable home loans article.

However, Northern Inland does offer a fixed interest home loan with a linked offset account, see loan option here.

The interest rate on a home loan with a linked offset account may be higher than the interest rate on a non linked mortgage. The account keeping fees also may differ. Speak with the lender about different rates they can offer on each option to see what suits your circumstances.

Consider the Target Market Determination, and Product Fact Sheet, to see if an offset account suits your needs. Speak to your accountant or financial planner for personal advice.

Can I offset 100% of my mortgage?

Yes, in most cases you can. Full offset accounts mean you only have to pay back the loan principal for the remainder of the loan if you keep it fully offset.

Example: If you have a mortgage balance of 100,000 and you have $100,000 or more in an offset account you have effectively prevented paying interest on the loan balance.

At Northern Inland, please note that you would still be required to make your regular loan repayments, which include any monthly account keeping fees.

Whilst a complete offset may be technically possible, you should speak to your accountant and financial planner as to whether it is in your interests to do so.

Check with your financial institution as to what percentage of your offset account balance, is offset against your loan account balance for the purposes of interest calculation. At Northern Inland, 100% of your offset account balance offsets your loan account balance, as measured at the close of business.

In what name can an offset account be established?

At Northern Inland, an offset account must be in the same name as the borrower. If a loan is in joint names, the offset account can be held in joint names or in each of the individuals names. However, if a loan is in a single name offset accounts cannot be established in joint names. Offset accounts cannot be opened where the account is in a different name, such as a company or in a relatives name.

Additional ways to maximise your offset account balance

The more money you are able to maintain have in your offset account, the less interest you may be charged on your loan account. At Northern Inland, interest is charged on a daily calculation as at the close of business.

You may wish to consider how you access your offset account balance, and how you pay expenses, to maximise your offset account balance.

Investigate payment options with your various providers. Some will allow you to pay by the month (or more frequently) by way of direct debit. Some may charge for this option. Ensure you have all the relevant information regarding your options, and any associated fees, before you make a decision.

Using a credit card

Credit cards usually have a 30 day interest free period, which you can use to your advantage.

If you buy everything using a credit card and leave the repayment as late as possible to pay the account in full, you will have maximised your savings balance in your offset account to the benefit of reducing the calculated interest on your home loan.

If you are considering this as a budgeting strategy, please bear in mind:

-

You need to repay the balance of your credit card in full by the due date or you will incur interest on your credit card account

-

You should look at automating your payment to your credit card to ensure you do not miss the due date.

At Northern Inland you can set up an automated repayment for the balance of your Visa Credit Card, to make sure your payments is made on time.

Consider the Target Market Determination, and Product Fact Sheet, to see if a Visa Credit Card suits your needs. Speak to your accountant or financial planner for personal advice.

Is it better to have money in offset accounts or savings account?

When deciding whether to use an offset account, consider:

-

When you earn interest on a savings account, the interest is income and is reported to the Australian Taxation Office. It is included in your tax return

-

An offset account is not an interest bearing account. For the purposes of interest calculations on your loan account, it acts to reduce the outstanding balance upon which the interest is calculated

-

The respective interest rates on your savings account, and on your loan account.

You should always seek advice from your accountant or financial planner, which takes into account your personal circumstances, before making a decision.

What's the difference between redraw facility and offset facility?

With an offset account (offset facility) you make all of your money work for you because whatever you have in your account offsets your loan balance for the purpose of loan account interest calculations.

There are other options to reduce the interest you pay on your home loan which offer less flexibility but have fewer of the drawbacks of an offset facility.

Additional repayments

You can bring your loan balance down by making additional repayments on top of your regular repayments with eligible home loans. This can help you pay off your home loan faster without needing an offset account.

This is a home loan feature that can help you save on interest by adding extra funds directly to your mortgage.

What is a redraw facility?

A redraw facility allows you to redraw money from your mortgage if you have made that are additional repayments and are in advance on your home loan. Some lenders charge a fee for redrawing on your loan or they have a minimum redraw amount.

Which loan type is better?

There is greater flexibility with an offset account compared to a basic home loan with additional repayment and free redraw facilities.

You should consider flexibility, and the differing interest rates offered between a home loan with offset facility and without offset facility.

When should I use an offset account?

Having an offset account is best when you have a substantial balance in your account. The benefits of an offset account are limited if you have small daily balances in your offset account.

If you have large sums coming in and out of your account regularly, an offset account can benefit you significantly because you get the benefit while the money is in the offset account at the time when loan interest is calculated. At Northern Inland, this is at the close of business, daily.

Is an offset account worth it?

An offset account can save money by reducing your interest costs, interest paid over the life of a loan can be significant. It can help pay off your home loan faster too!

When comparing to other loan types you should consider all components of the loan, interest rates, fixed or variable interest, fees, comparison rate, redraw facility and the flexibility it provides you. Different home loans suit different circumstances.

Speak with one of our Lending Specialists to see which loan type suits you best, contact us.

This article is general in nature and does not constitute personal advice. Consider your circumstances and read terms and conditions of the Product Fact Sheet, and Target Market Determination, before making a decision. Always speak with your accountant and/or financial planner for personal advice which is tailored to your circumstances.